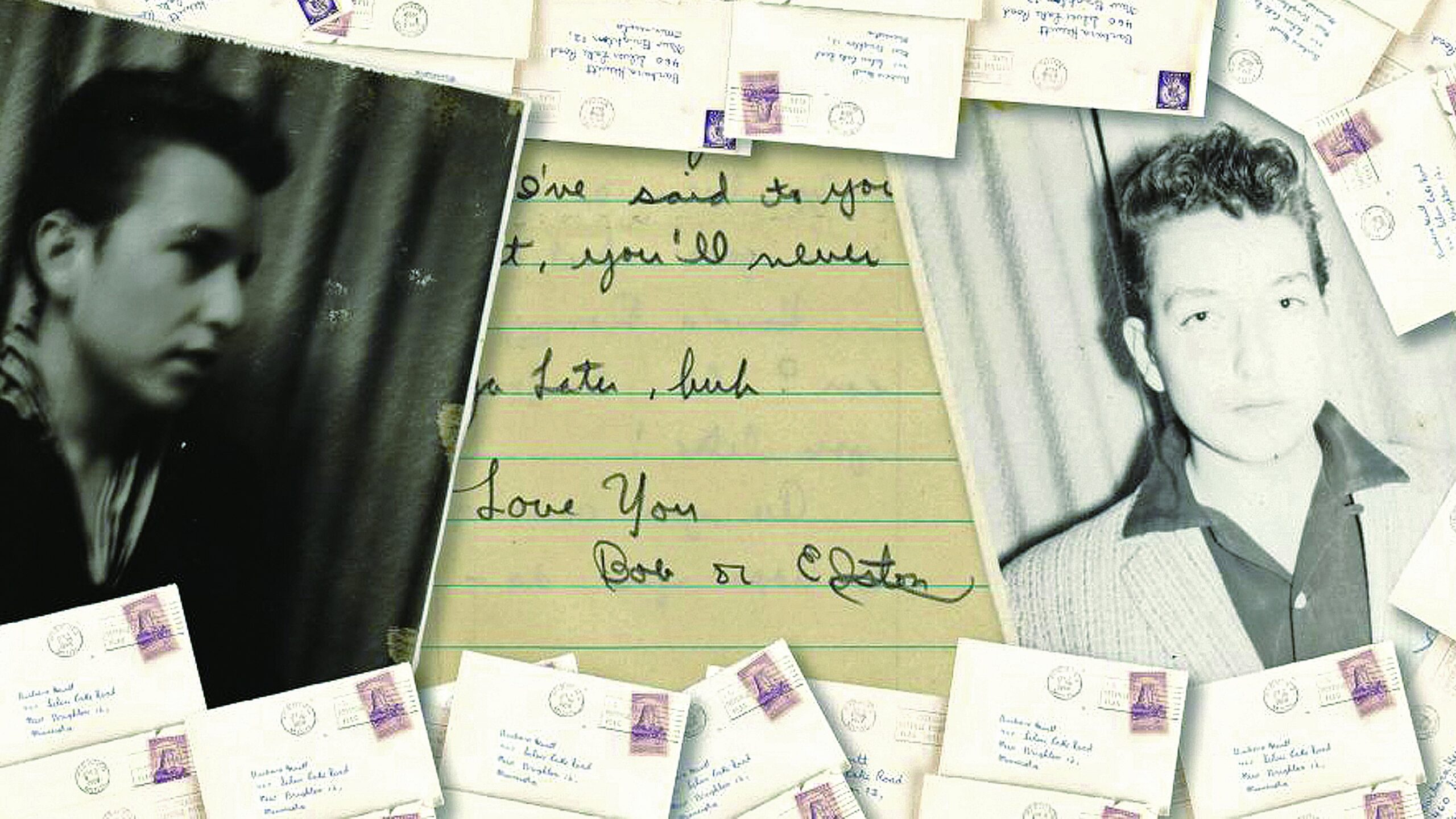

NFTs: Future of investment or another bubble waiting to burst?

The world is now divided into two types of people: those who invest in NFTs and those who don’t. As mind-boggling as it is, an increasing number of people now use digital currency to purchase digital goods – or rather the certificates that legitimises ownership of said items – without ever having to physically touch them at all.

NFTs have been around since 2014, but they were relatively low profile before the end of the decade. They really began sweeping the internet last year, when this novel technology went mainstream and disrupted industries across the board, especially the art world. The NFT landscape has rapidly evolved over the past 12 months, with more institutions around the world and some governments recognising cryptocurrency as legal tender and NFTs as strong investments.

Even a traditional international art auction house like Sotheby’s has launched its own Metaverse dedicated to NFTs and digital art. So, those few who still staunchly prefer cash in hand might just have to come to terms with this new digitalised transaction that is revolutionising the financial, investment and creative sectors.

Cryptocurrency and NFTs: What’s the difference?

An NFT (non-fungible token) is a unique digitalised certificate that entitles one, and only one, person to exclusive ownership of an asset. Cryptocurrency is a peer-to-peer electronic cash system, such as Bitcoin, Ethereum and Doge, used to purchase NFTs. Blockchain is the platform on which all cashless digital transactions happen. The process is calculated by a large group of computers and recorded publicly, but anonymously, on the internet to ensure everything adds up. This provides transparency and avoids human error or the risk of financial mismanagement.

Yet, the use of digital ownership tokens remains controversial. While championed by artists and tech-savvy investors, others are cautious, citing a volatile, unregulated marketplace. Environmental campaigners, in particular, decry the huge amount of energy they eat up. What does that mean for Hong Kongers looking to invest in NFTs? And is embracing crypto a positive move for society? We break down the pros and cons…

Democratising art and the value of scarcity

NFTs spurred a creative boom for developers and artists last year. Helping to democratise art, they allow creators control and ownership of their created content while also sharing deserved revenue, and offering involvement in a community of like-minded individuals. The key takeaway here is that NFTs are one-of-a-kind, non-fungible and certified original tokens of an object, whose value is dictated by the community, not an institution or an art market.

Pro: They certainly benefitted Hong Kong high schooler, illustrator and graphic artist Andrew Mok. Also known as Offgod, Mok is a cover artist for social media rappers such as Bella Poarch, The Kid Laroi, and the late Juice Wrld. He was invited to do an NFT exhibition – his first solo exhibition – at Shout Art Hub & Gallery in Hysan Place – a gallery dedicated to NFTs and digital art and providing global support for local artists. “Offgod’s skill is very mature and creative with his own style and he has over 200,000 followers on social media from all over the world,” says gallery founder Christopher Tang. “The feedback from the market exceeded my expectations. We sold every art piece by the end of the first week – and some pieces pre-sold before the exhibition opened, which for a [then] 17-year old local artist is a miracle.”

Con: Difficulties arise when talking about value and how volatile the NFT marketplace can be. Unlike stocks or bonds, there is no way of knowing the intrinsic value of an NFT investment. What makes a successful NFT largely depends on how the popularity of the brand is, and how strongly the community feels about it.

The scarcity principle used in economics, social psychology and manipulating consumer behaviour theorises that greater value is placed on items that are scarce or in low supply, but in the case of NFTs, it is perhaps the exclusive ownership of a token that creates value rather than the uniqueness of the object itself. Why else would crypto entrepreneur Sina Estavi pay US$2.9 million for Twitter CEO and founder Jack Dorsey’s first tweet?

Pushing the boundaries of technology

There is one thing that is undeniable about the technology behind blockchain and cryptocurrencies, and it is that it has pushed the boundaries of how society and systems utilise computers for the purposes of validation and verification. As evidence by the 2008 financial crisis following the collapse of Lehman Brothers, there is room for error and risk of mismanaging financial systems when regulators are in a position to control funds.

Pro: Blockchain technology is a complex system that allows for strong security since it acts as a shared, immutable ledger; it is almost impossible to hack, alter and manipulate because all transaction records are publicly documented, in contrast to transactions conducted on traditional platforms.

Cons: However, ideal and utilitarian the blockchain is in theory, without the middleman or an institutional buffer between consumers and retail, NFTs leave investors vulnerable. Their value is volatile, and there is still the potential for fraud, scam and theft during transfers within the NFT marketplace, despite the security of blockchain and the anonymity it allows. The process and language can be complex as well, especially for those new to the NFT scene.

If the goal is to truly democratise blockchain and the NFT market for the masses, the exponential growth will require an institutional buffer to aid buyers and investors to oversee the marketplace, as risk in their trade is still very much present.

Future or fad?

Whichever side one stands on the debate of NFTs as the future of investment, there is no denying the good they have reaped for artists and creators, inspiring them to take the lead in how their own creations are presented in the market. Artists have been enabled to deal directly with buyers and control the revenue they earn, while building communities of like-minded individuals with the same interests, fostering a positive and empowering influence for creators.

However, there are fears that a new law that will come into effect next year will stymie the growth of cryptocurrency in the city. The new legislation states that virtual asset trading platforms will face regulations and be monitored through a licensing system to prevent illegal activities, particularly money laundering. This will undermine the main point of decentralising, but perhaps it is a middle ground both sides can come together on.