State of the art: Amid a waning appetite for artworks as assets by the rich, the market still draws investors’ confidence

A recent report presents a mixed picture of the spending habits of the ultra-wealthy on art, and the state of the art market. In gloomy news for sellers, it found that high-net-worth individuals (HNWIs) reduced their average expenditure on art by almost a third last year and the share of their wealth portfolio devoted to art has dwindled. Yet analysts – including the report’s author – still point to the market’s underlying health, which will please those looking to buy art as an asset in the year ahead.

Authored by Clare McAndrew of Arts Economics, the Art Basel and UBS Survey of Global Collecting 2024 acts as a microscope on the long-term dynamics of the art market. Last year’s 32% reduction in art spending by HNWIs reversed a recent trend of resilience up to 2023. Global art market sales fell to US$65 billion after two years of consecutive growth. This comes on the back of an earlier Art Basel/UBS report pointing to a cautious buying environment.

Yet, according to McAndrew, these aggregate figures hide a healthy base that is underpinning the art market as a whole. While citing “the very thin number of works over US$10 million, which have really contracted in terms of supply” as a dampener, she suggests that other parts of the market, especially at the lower end, are faring well.

High-end stall

She explains that the high end of the market is driven by the vendors and whether or not they perceive it as a good time to sell. Their decision to withhold big-ticket items from the market will be influenced by the likes of economic uncertainty and geopolitical factors including major wars and conflicts. It is a very perception-driven market, partly due to a lack of transparency in some sectors. “Dealers at fairs know it is a tough time at the higher end, so they tend to bring the things they know will sell – it becomes a little bit of a cycle that way,” notes the respected cultural economist.

SVN Capital CEO Stefan Terry, who advises on all aspects of art investing, concurs that these potentially worrying figures are skewed by sales and “statistically difficult-to-read” transactions at the top end of the market, thus do not constitute a health check for the whole market. He also attributes the reduction in spending by the ultra-wealthy last year to fewer masterpieces being offered for sale.

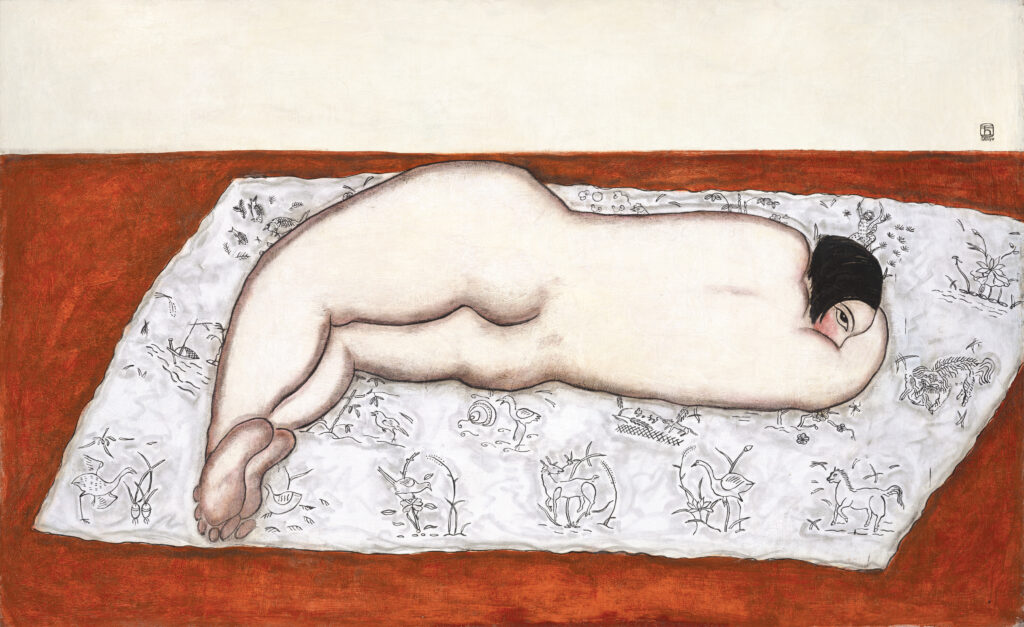

“It’s important to look at the nuances of the market, which reveal a more positive outlook,” he says. “Though the millennial market has been more cautious recently, Gen X appears to be maintaining a high level of demand for art. The same is true of buyers more generally in Asia-Pacific, where the market continues to demonstrate robust health.”

Terry also alludes to the fact – as noted in the report – that HNWIs in mainland China racked up the highest expenditure on art and antiques in 2023 and the first half 2024 compared to other countries.

Art share fall

The report highlighted a fall for the second successive year in the allocation of art within HNWIs’ portfolios. It now accounts for 15% of their wealth, down from 19% in 2023, and 24% in 2022.

Terry, though, remains bullish, pointing out that more than 85% of HNWIs surveyed felt art was a relatively safe investment compared to other traditional assets. He also notes that institutions have poured money into making alternative assets more appealing, and only time will tell if this is a long-term trend. “Whilst art has been transacted with the help of dealers and auction houses for hundreds of years, many of these [newer] assets are yet to prove their market depth and liquidity condition,” he says.

McAndrew expressed surprise at the decline in the proportion of art in wealth portfolios, given that art is tangible and real and is generally considered a stable investment. She feels some buyers, especially in the US, may have been impacted by higher interest rates in the past few years – according to a previous report, more than 40% of HNWIs utilised lending or credit when purchasing art for their collections. “They were leveraging different parts of their wealth portfolios and they used artworks either as collateral for lending, or they used lending to purchase artwork,” she says.

She also emphasised that art is a relatively illiquid asset, and as the opportunity costs of holding it increase, people may seek an investment that can be more easily liquidated.

The status-signalling aspect of buying art could be another bearish factor at play in some parts of the world. As noted during the 2007-2008 global financial crisis, purchasing high-end art may have lost its appeal for some. “If it is not perceived as a cool time to be flashing the cash, as it were, then some of the social aspects that motivate people to collect art become less of a driver, and they may hold off and wait till things pick up,” explains McAndrew.

Framing the positive

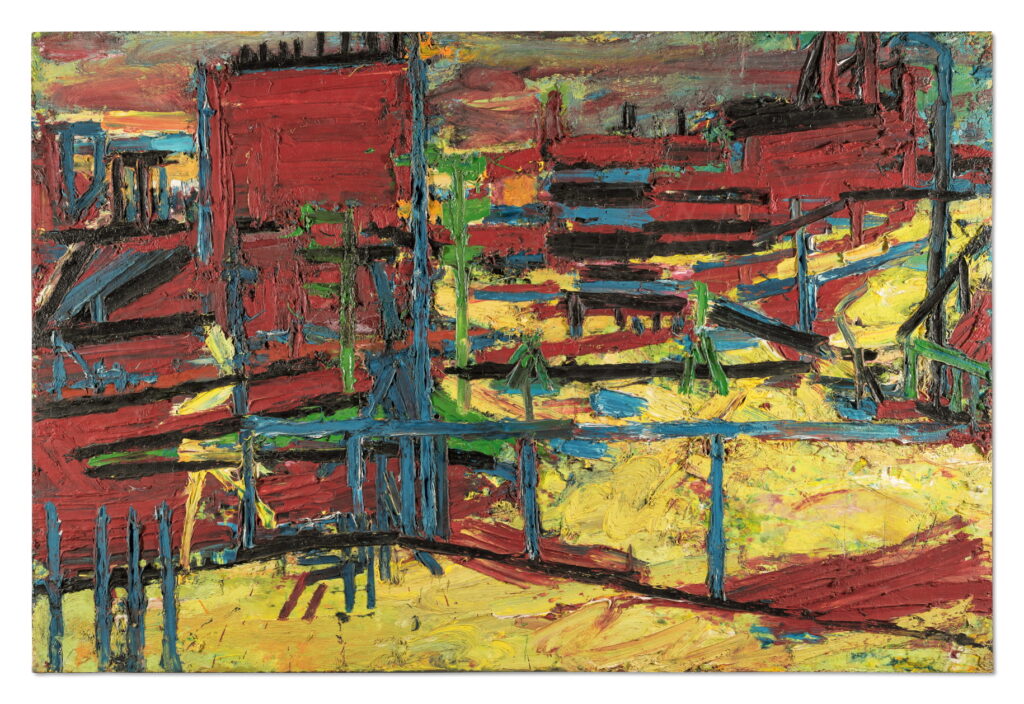

The report did highlight some positive trends that reflect well on the state of the art market. For instance, over half the spending (52%) of HNWIs was placed on new and emerging artists and the vast majority also purchased from new galleries last year. Collectors are attending more exhibitions and events than they did pre-Covid, and the survey suggests the overall volume and transactions of art sales are increasing.

“This is a sign of strong resilience in the market: at a time of global uncertainty, collectors remain committed to broadening their horizons and are allocating budget to buying outside of their comfort zones,” says Terry.

Another strengthening trend is the growth of online sales of artwork, a change in buying patterns which has continued from the pandemic. McAndrew believes many wealthy art buyers now prefer to do a transaction themselves at home sitting at a desk, even if they have seen the work in person. This means that galleries have to focus on both their live exhibitions and their digital programmes. Some analysts also point to latent demand in the online art sector that has yet to be filled.

The market could be energised in the future by the fact that US billionaires are expected to transfer some US$6 trillion in wealth and assets to heirs and charities over the next 20 to 30 years – which will include huge art collections covering contemporary and modern artists. “Whether the recipients choose to keep or sell the artworks among these assets will have big implications for future average spending [on art],” says Terry.

Investor opportunities

Garth Grierson, founder and CEO of Hong Kong-headquartered Art Curators Hub, which connects artists with buyers, believes that Covid prompted a reset in the art market and sellers have not come to terms with the fact that many works cannot be valued against past auction records. “Prices must be set at more realistic levels, then art will begin to sell more easily,” he says.

“Confidence will rise and prices will climb once more.”

Grierson sees the current situation as ideal for the acquisition of some very well-priced art, and given the reduction in the number of buyers at the high end of the market, the chance to procure excellent investment pieces. He also notes that strong Chinese demand is driven by investors deciding to put money into art and antiques rather than stocks and shares.

Wealth manager Kenny Ho, founder and Managing Partner of Carret Private, highlights a recent rise in buyer interest in art as the ultra-wealthy who have made huge gains in US equities look for bargains. He notes, however, that many clients remain invested in the more liquid equity markets, where returns continue to be strong following Donald Trump’s victory in the US presidential election.

Hong Kong hub

A key finding of the 2024 Survey of Global Collecting was Hong Kong’s continued strong demand for art imports. McAndrew believes the city ticks all the boxes as an important art trade hub: a wealthy population, a comprehensive art infrastructure embracing galleries, fairs and artists, and a positive regulatory environment.

“Art is a global market which we all know is cyclical,” says Elaine Holt, Chairman of Modern and Contemporary Art at Sotheby’s Asia. She noted a surge in new clients during their recent sales season in Hong Kong, as well as solid results in other centres, and eagerly anticipates the return of Art Basel Hong Kong in the spring: “This is one of the most exciting weeks for the art world, and this city, as collectors descend from all around the globe.”